Taxi Card Payment Readers

In today’s increasingly cashless society, offering taxi card payments is crucial for taxi businesses. iCabbi’s taxi dispatch system integrates seamlessly with card payment readers, ensuring you never miss out on fares due to payment limitations.

The Shift to Cashless Transactions

In 2020, over half of all transactions were made with credit or debit cards*, a trend that has continued to grow. Cash usage is decreasing by approximately 15% annually, marking Britain’s shift towards a cashless and contactless society.

For taxi firms competing with ride-hailing giants like Uber, having taxi card payment facilities is essential. It ensures relevance to customer demands and enhances the overall driver experience.

Seamless and Secure Payments

Convenience is key, offering contactless payment options builds trust and loyalty among your passengers. When customers know they can pay with a card, they’re more likely to choose your service over the competition. iCabbi’s taxi dispatch system integrates seamlessly with card payment terminals, ensuring fares are processed quickly.

This not only reduces the chance of error or fraud but also allows drivers to focus on delivering excellent customer service instead of handling cash. By embracing secure, cashless transactions, you can stay ahead of evolving customer expectations.

Request a Free Demonstration to see why iCabbi is the go-to choice for taxi businesses across the UK.

Or call us on 01623 442211, or email us and we can help get you started.

24/7 UK Based Support

Because your business is 24 hours a day, 7 days a week, 365 days a year, our support is too. We operate a dedicated help desk Monday – Friday, 9am – 5pm, with emergency support available at all other times.

Benefits of Taxi Card Payments:

-

-

- Speed and Convenience: Payments are faster without the need to count change

- Reduced Fraud Risk: Minimise the risk of counterfeit money

- Increased Fare Opportunities: Cater to passengers without cash

- Hygienic and Safe: Contactless payments are more hygienic, reducing physical contact and the risk of theft

- Seamless Integration: Prices are automatically transferred from the Driver App to the terminal and payment information is sent back to iCabbi, recorded in booking and payment reports

- Quick Payment Processing: Payments to drivers can be made within 24 hours or go towards their driver rent, all fully configurable

-

Boost Revenue

Boost Revenue

Implementing taxi card payments through iCabbi doesn’t just enhance customer satisfaction, it also streamlines your operations. Automatic fare calculations, quicker transactions, and real-time payment reporting mean drivers spend less time managing finances and more time on the road, increasing revenue. Meanwhile, fleet owners gain valuable transaction data, enabling informed decisions about driver accountability, shift scheduling, and other service improvements.

By harnessing the power of an integrated card payment system, you can increase profitability and maintain a competitive edge, all while delivering a modern, convenient experience to your customers.

Our Packages

We offer a variety of packages and features depending on your operation. Whether you’re a start-up or a national firm, you will be able to find an iCabbi package that suits your business’s needs.

Take a look at our most popular packages below:

Growth

Includes Essentials Package plus:

- Phone system report suite

- Customer booking app

- Free unlimited number ports

- Free additional softphone

- Free website

- Free web booker

- Free Stripe PIN pads

From £56 + VAT per week

Essentials

Includes Just Dispatch package plus:

- Phone system

- 2 x SIP channels

- Free softphone licence

- Free number port

From £41 + VAT per week

Just Dispatch

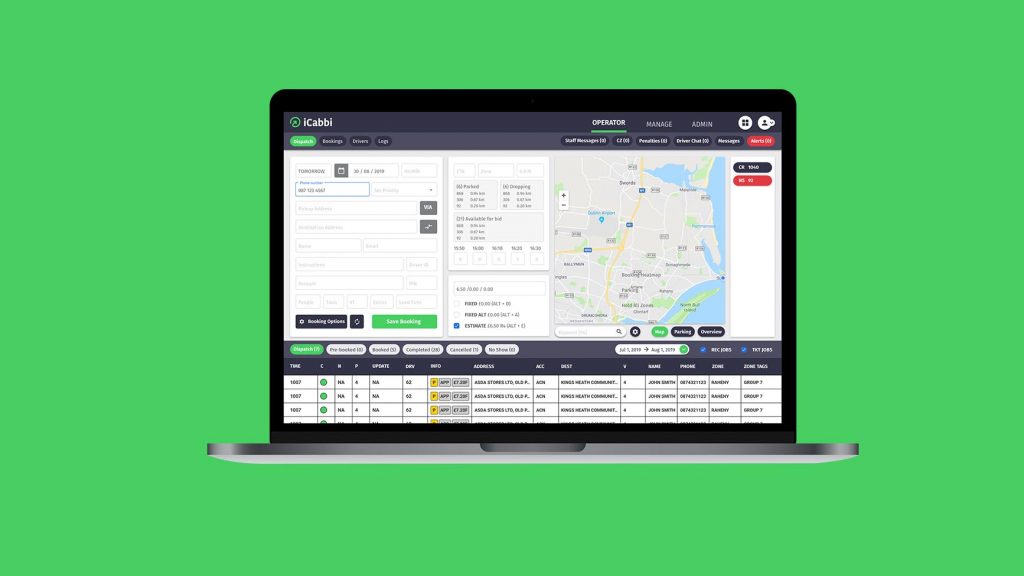

iCabbi’s industry-leading taxi dispatch software package includes:

- 5 driver licences

From £23 + VAT per week

TOO EXPENSIVE? Refer friends or family and get £300 account credit each time!

Card Payment Terminal Features:

-

-

- Contactless and Mobile Payments: Supports Apple Pay, Google Pay and Chip & PIN.

- In-vehicle Advertising: Each unit comes with three in-vehicle stickers to promote card payment availability.

- Easy Connectivity: Connects via Bluetooth to the iCabbi Driver App.

- Direct Payment Handling: Payments are sent directly to your Stripe account, used for other iCabbi products.

-

What’s Included in Our Taxi Card Payments Offer?

-

-

- Free Pin Pads: Offered to fleets committed to providing passengers with taxi card payment options.

- Transaction Requirements: Fleets must average 20 transactions per PIN Pad per month to avoid a small charge.

- Driver Ease: Only 5 card jobs a week per driver are needed to meet the transaction requirement.

-

Plus you can get your taxi card payment device for FREE!**

Book A Free Demonstration

Discover how iCabbi can help to transform and grow your taxi business with a free demonstration with one of our industry specialists today!

15-minute introductory call

*Source for data: UK Finance Payment Markets Summary 2021

**Fleets must average 20 transactions per PIN Pad per month, or we reserve the right to administer a charge of £2.99 + VAT per month per PIN Pad. For example, if 10 devices are supplied, the fleet is expected to complete at least 200 transactions (10 PIN Pads x 20 jobs). Your drivers simply need to complete 5 card jobs a week.

Boost Revenue

Boost Revenue Free Buyer’s Guide8 Key Questions to Ask Before Investing in a Cloud-Based Dispatch System – and the Costly Mistakes to Avoid

Free Buyer’s Guide8 Key Questions to Ask Before Investing in a Cloud-Based Dispatch System – and the Costly Mistakes to Avoid Free DemonstrationDiscover how iCabbi helps you get more bookings and cut your costs – see for yourself with a no obligation demonstration now...

Free DemonstrationDiscover how iCabbi helps you get more bookings and cut your costs – see for yourself with a no obligation demonstration now... Check out our BlogGreat information, ideas, hints and tips for your taxi business...

Check out our BlogGreat information, ideas, hints and tips for your taxi business...